Medicare Part D: Prescription Drug Coverage

Medicare Part D plans (otherwise referred to as prescription drug plans) are offered through private insurance companies and provide help with the cost of prescription drugs. These plans may be purchased either as a stand-alone (Part D) prescription drug plan or as part of a Medicare Advantage (Part C) prescription drug plan. Medicare Part D plans have monthly premiums that vary depending on which plan you choose. You may also be subject to a penalty if you do not enroll in Part D when you are first eligible.

Remember: you must always continue to pay your Medicare Part B premium.

There are several Medicare Part D plans to choose from, varying in cost and in their formulary (or list of specific drugs covered), but all are structured in the same way. Meaning, there are 3 stages of drug coverage:

- Initial Coverage Stage: during this drug stage you pay a co-pay (flat fee) or co-insurance (percentage of a drug’s total cost) for each prescription that you fill until your total drug costs reach a specified limit set each year.

- Coverage Gap Stage (“Donut Hole”): after your total drug costs reach the Initial Coverage Stage limit, you enter the coverage gap stage – where you pay a percentage of the cost for brand name and generic drugs. You stay in this stage until your out-of-pocket costs reach the next limit set each year.

- Catastrophic Coverage Stage: after your out-of-pocket costs reach the Coverage Gap Stage limit, you enter the catastrophic coverage stage – where you pay a small co-pay or co-insurance amount for each prescription. You stay in this stage for the remainder of the calendar year.

With all Medicare Part D plans, you will pay a share of the cost of the medications you take. Each plan that provides drug coverage, whether it’s a stand-alone plan or a Medicare Advantage plan with drug coverage built-in, will include cost-sharing and each plan will also share costs differently.

If you need prescription drug coverage, together we will select the plan that is right for you based on your medication requirements. We can also determine if you qualify for the ‘Extra Help’ program which can significantly lower your prescription drug costs.

How Much Does Part D Cost?

Medicare Part D plans vary in monthly premium amount, depending on which plan you choose. Ultimately, your actual plan costs will vary depending on the drugs you use, the plan you choose, and which pharmacy you use.

If you need help finding the right Part D plan, we can help select the plan that is right for you.

Note: if your modified adjusted gross income is above a certain amount, you may pay a higher Part D premium. This is referred to as an Income Related Monthly Adjustment Amount (IRMAA).

What Does Part D Cover?

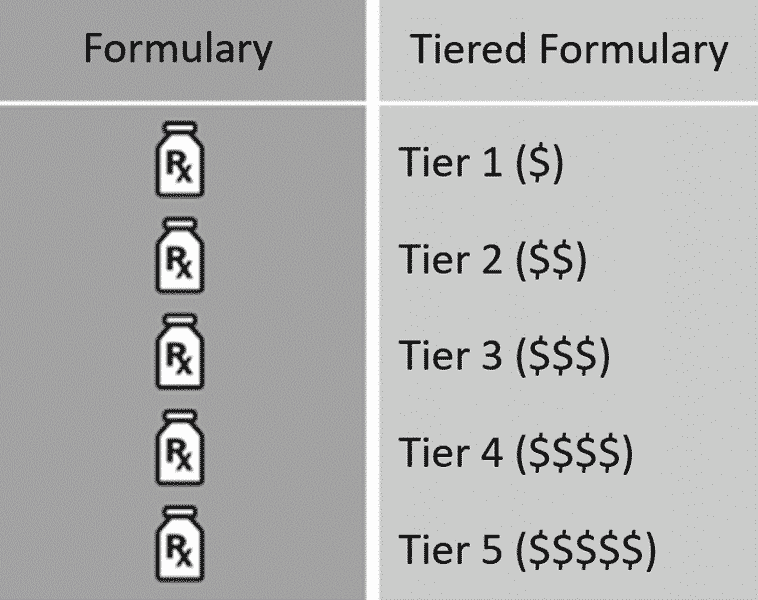

Medicare Part D plans provide help with prescription drugs. Each plan has its own list of covered drugs, called a formulary. Many Part D plans use a tiered formulary, which means they divide drugs into groups called ‘tiers’ based on cost. Typically there are 5 tiers, with Tier 1 drugs being the least expensive and Tier 5 drugs being the most expensive.

Note: medications not on a plan’s formulary may not be covered.

How Do I Sign Up for Part D?

Each private company that offers Medicare Part D plans has its own enrollment process. When you’re ready to join, we will help you expedite that enrollment process – at no cost to you.

When Can I Sign Up for Part D?

o sign up for a Medicare Part D plan, you must:

- be enrolled in Medicare Part A or Part B

- permanently live in the Medicare Part D plan’s service area (based on state)

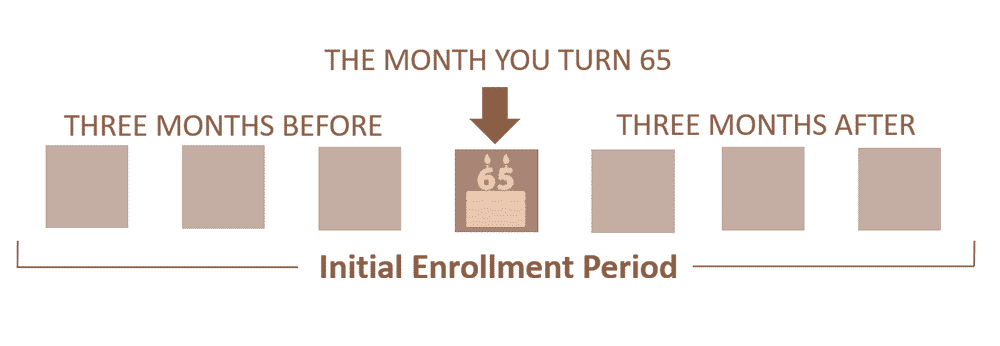

Initial Enrollment Period

The 3 months before your 65th birthday, the month of, and the 3 months after

IEP: Initial Enrollment Period

Your initial enrollment period (IEP) begins 3 months before, the month of, and ends 3 months after the month of your 65th birthday (giving you a 7-month window). You can choose any type of Medicare Part D plan during the IEP.

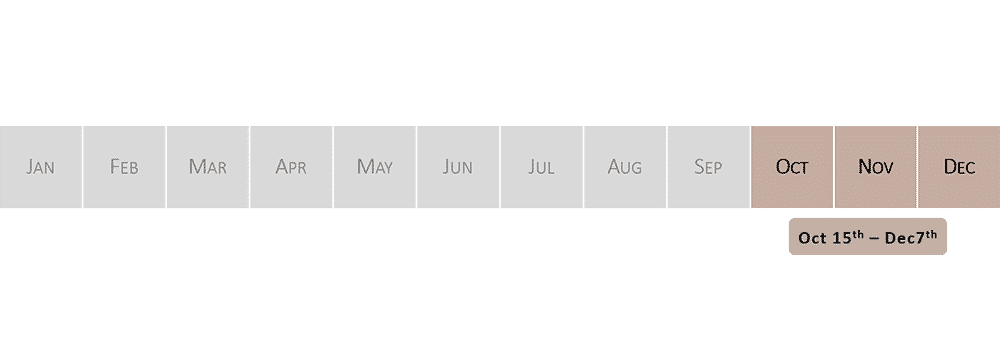

Annual Enrollment Period

Every year between October 15 – December 7

AEP: Annual Enrollment Period

Each year during the annual enrollment period (AEP) you can join or change a Medicare Part D plan. AEP runs from October 15 – December 7 of every year. Special Enrollment Period

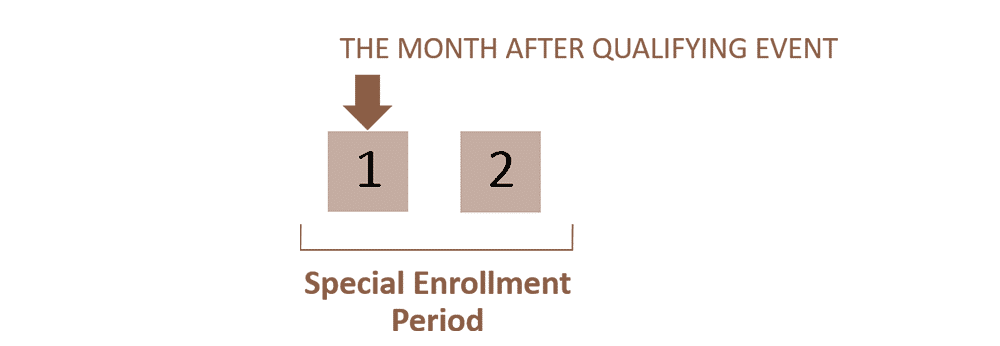

Up to 63 days to enroll in Part D

SEP: Special Enrollment Period

A special enrollment period (SEP) allows you to enroll in a Medicare Part D plan outside of IEP or AEP if certain specific circumstances apply to you. For example: if you were working past age 65 and had creditable coverage from an employer or union group plan, then later lost that coverage due to retirement or loss of employment. During a SEP you are given a 63 day window (beginning with loss of creditable coverage) in which you can enroll in a Medicare Part D plan.

Note: You may be subject to a penalty if you don’t sign up for Part D when you are first eligible – unless you qualify for an exception. The late enrollment penalty for Medicare Part D is an additional 1% (of the national average premium amount) for each month that you could have had Part D but didn’t sign up for it. You will pay the penalty for as long as you’re enrolled in Medicare Part D.

This penalty may not apply to you if you have proof of creditable drug coverage, which is defined as coverage that is at least as good as what Medicare Part D plans are required to provide. Examples: VA drug coverage, many group employer, union, and retiree health plans.

Which Pharmacies Can I Use?

Each Part D plan has a subset of pharmacies known as their “preferred pharmacies”, where you can get your prescriptions for lower costs. Be sure to compare preferred pharmacy costs versus other non-network pharmacies to determine whether switching pharmacies might save a considerable amount.

What is the Late Enrollment Penalty for Part D?

You may be subject to a penalty if you don’t sign up for Part D when you are first eligible – unless you qualify for an exception. The late enrollment penalty for Medicare Part D is an additional 1% (of the national average premium amount) for each month that you could have had Part D but didn’t sign up for it. This penalty is added to your Part D plan’s premium and you will pay the penalty for as long as you’re enrolled in Medicare Part D. Since the national average premium amount may increase each year, the late enrollment penalty may also increase each year.

This penalty may not apply to you if you have proof of creditable drug coverage, which is defined as coverage that is at least as good as what Medicare Part D plans are required to provide. Examples: VA drug coverage, many group employer, union, and retiree health plans.

What’s Not Covered by Part D?

Here are some things Medicare Part D plans don’t cover:

- Vitamins

- Non-prescription drugs

- Weight-loss drugs

- Fertility drugs

- Drugs used for cosmetic purposes or hair growth

- Drugs used for erectile dysfunction

- Inpatient drugs

- Sleeping pills

What is a Tiered Formulary?

Each Medicare Part D plan has its own formulary, which is the list of drugs that a particular plan will cover. Many drug plans use a tiered formulary, meaning the plan divides drugs into groups called “tiers” based on cost. Typically there are 5 tiers, with Tier 1 drugs being the least expensive, gradually increasing in cost to Tier 5 drugs which are the most expensive. In other words, the lower the tier, the lower your co-pay.

Note: medications not on a plan’s formulary may not be covered. Other Important Terminology To Know About Part D

Step Therapy

Step therapy is a requirement for certain drugs, where you may be asked to try a less-expensive drug that can treat the same medical condition as your current drug, to see if it works for you. You may be asked to try one or more of these lower-cost drugs before the plan will cover the drug you are currently taking.

Prior Authorization

Prior authorization is a requirement for some medications, where your doctor must obtain approval from your Medicare Part D plan to prescribe a specific medication for you. This helps to ensure that drugs are prescribed and used correctly.

Quantity Limits

Some drugs have quantity limits, where the plan will cover a certain amount of drugs for a certain number of days. These limits are in place to ensure the safe and effective use of the drug.

Formulary Exception

If you need a drug that is not currently covered by your plan, you or your doctor may ask the plan to cover your drug even if it’s not on the drug list. This is known as a formulary exception.